You wouldn’t think twice about having insurance for your car or home – but what about for your pets? As pet parents, we never want to think about our furry, feathered, or scaled family getting sick or injured. Yet it’s always good to be prepared in case the unthinkable happens, a.k.a. that time Fido’s sock-eating habit turned into emergency intestinal surgery. Want to determine whether pet insurance makes sense for your family? We’ve covered some of the top-asked questions here, including a helpful plan comparison chart to weigh your options!

How does pet insurance work?

Similar to “human” health insurance, pet insurance plans come in all shapes and sizes. The bottom line goal is to help you, the pet owner, pay towards health-related visits and procedures.

Plans by most companies will reimburse you directly after submitting an applicable bill, allowing you to use any licensed veterinarian, emergency clinic or specialist in your area. They help cover costs associated with accidents and illnesses, including hospitalizations and surgeries. Many plans even cover chronic and ongoing diseases, like skin allergies, and even the awful C word (cancer).

A common misconception is that pet insurance is only useful for “big accidents,” like a broken leg, but many plans also assist with routine wellness. This means that yearly checkups, regular vaccinations, and even dental cleanings can benefit from health insurance.

So what’s the catch?

One of the biggest downfalls of many pet insurance plans is that they will not cover pre-existing conditions that your pet has already been diagnosed with. Many will also not assist with conditions that are considered hereditary, congenital, or typical among the breed of your animal. French bulldogs, for instance, are a breed of dog commonly affected by hip dysplasia. Many insurance carriers will not offer coverage for this condition in this specific breed, as it so often occurs.

Are there insurance plans for pets other than just cats and dogs?

Though they’re labeled “pet insurance,” the majority of plans out in the market today cater solely to cats and dogs. If you own a different kind of critter, fear not! Nationwide offers an Avian & Exotic Pet insurance plan covering the following species:

- Amphibians

- Chameleons

- Chinchillas

- Ferrets

- Geckos

- Gerbils

- Goats

- Guinea pigs

- Hamsters

- Hedgehogs

- Iguanas

- Lizards

- Mice

- Opossums

- Potbellied pigs

- Rats

- Rabbits

- Snakes

- Sugar gliders

- Tortoises

- Turtles

There are also insurance options for horse owners, including major medical (illness and injury), surgical (operation expenses), mortality (for accidental or illness-related deaths), and loss of use (in the event your horse can no longer be ridden or shown). Many private insurance agencies offer forms of Equine and Livestock insurance, but there are also equine-specific groups like American Equine.

So do I need pet insurance?

Every pet is unique, but answering these few questions can help you determine if pet insurance makes sense for your family.

1. Is your pet young? (Under 2 years of age)

2. Is your pet “mischevious” or accident-prone?

3. Is your pet’s family history/lineage unclear?

If you’ve answered yes to the above questions, then it sounds like pet insurance might be in your favor. Why? For starters, young pets with insurance wellness plans will see the immediate benefit, as many of the routine vaccinations and procedures take place during the first few years of life.

If your pet is generally mischevious – like a dog who makes Evel Knievel leaps from tall furniture or a kitten who loves to snack from the garbage can – then pet insurance can save the day if an accident arises.

Finally, pet insurance can be wise if you’re unsure of your pet’s breeding history. Mixed breeds can make for an unclear medical history, making it difficult to prepare for major health issues. Having insurance can provide peace of mind for your fur family member.

As with human insurance plans, each case is different. There are those who never make an insurance claim, and those whose lives are saved by the financial assistance they receive from having insurance. The choice is yours!

How much does pet insurance cost?

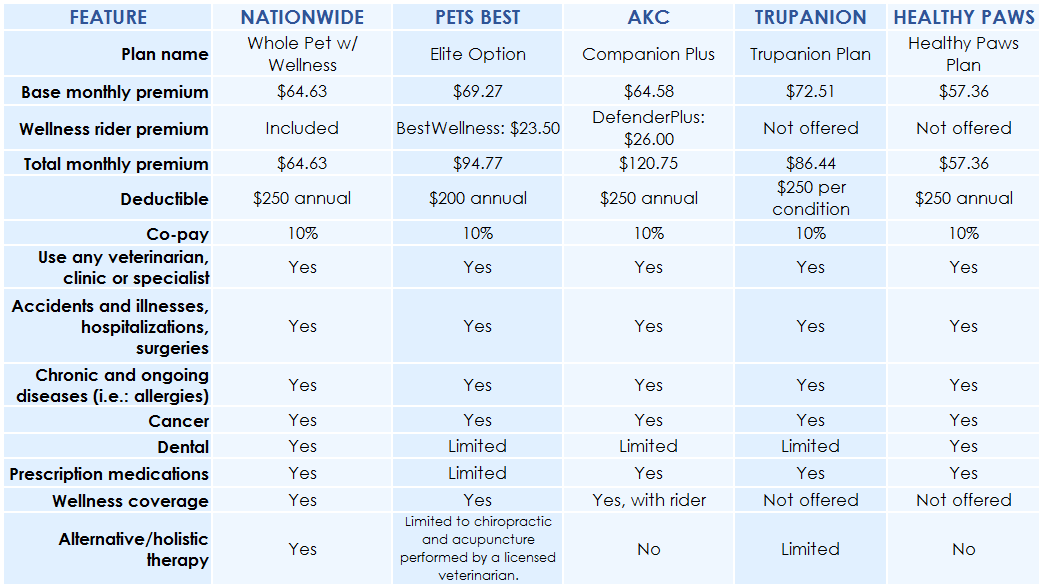

Every insurance plan is different, with things like animal breed, age, and existing health condition factoring into the overall cost. Below is a chart comparing the costs and coverage for a Labrador Retriever from some of the most popular pet insurance carriers.*

Keep in mind, these quotes are just estimates and may differ based on the pet you’re looking to insure.

In return, pet owners will receive around 70-90% reimbursement for applicable vet and hospital bills depending on the plan and insurer.

How do I enroll in pet insurance?

If you’ve decided that pet insurance is the way to go, it’s very easy to enroll in a plan. Pet insurance through major carriers, like Nationwide and Allstate, can be added on to existing plans by contacting your local agent. Virtually all carriers, including Pet’s Best, TruPanion, and Healthy Paws, allow you to request a quote and sign up for coverage online. Visit the website (or Petworks) of your desired company to get your pet protected today!

_

*Pet insurance comparison data is provided using available information from the web and is only meant to summarize. Please review the respective policy terms and conditions for specific details on each individual insurer. If there are questions regarding the above chart, please contact an agent of Nationwide, the Hartville Group (ASPCA), Pets Best Insurance Services (Progressive), PetPartners, Inc. (AKC), Trupanion, and Healthy Paws Pet Insurance, LLC.